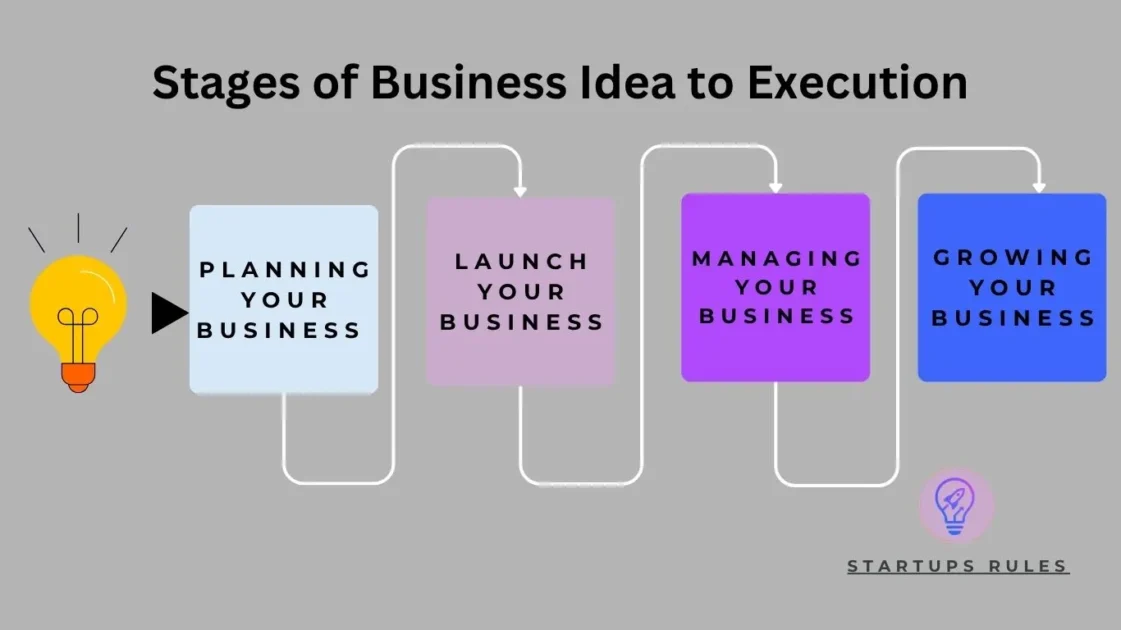

Starting a business in India has become easy as Government supports Ease of Doing Business in India. India is the 6th largest economy of world with a thriving startup ecosystem, and strong government support through initiatives like Startup India, you have a lot of opportunities to turn your business ideas into successful startup. But before you launch your business, one crucial step is — company registration.

Registering a company in India is not just a legal requirement; it is the first stone of foundation of building a successful business. It gives your business a separate legal identity, protects personal assets, allows you to raise funding, and builds trust with your customers, banks, and investors. In 2025, the process has become more simple and digital, thanks to the MCA’s SPICe+ portal and single-window clearances that save time and effort.

In this step-by-step guide, we’ll walk you through everything you need to know about how to register a company in India in 2025 — from choosing the right business structure, checking business name availability, preparing documents, filing forms online, to receiving your Certificate of Incorporation (COI). Along the way, we’ll also share practical tips, common mistakes to avoid, and useful resources to register your business in India.

Why company registration matters in India for entrepreneurs & startups

Registering your company gives your business a legal identity, it separates you from your business to as an individual. This separation matters because it helps to:

- Builds credibility with investors, banks, and customers.

- Ensures legal protection for you and your business.

- Opens doors to funding, government schemes, and tax benefits.

- Helps you scale smoothly without running into compliance issues later.

Many first-time entrepreneurs overlook the registration process, but skipping it can lead to legal troubles, difficulty in raising capital, and even loss of trust from potential clients.

Importance of legal compliance for credibility, funding, and scalability

Think of registration as setting the foundation for your business building. Without it, you may face:

- Credibility gaps: Clients or corporate partners often prefer working only with registered entities.

- Funding roadblocks: Investors, banks, and VCs usually require a proper Certificate of Incorporation before investing.

- Scalability issues: Without compliance, expanding your team, opening branches, or applying for licenses can become a nightmare.

Simply put, if you want your idea to grow into a recognized, trusted business, registration is non-negotiable.

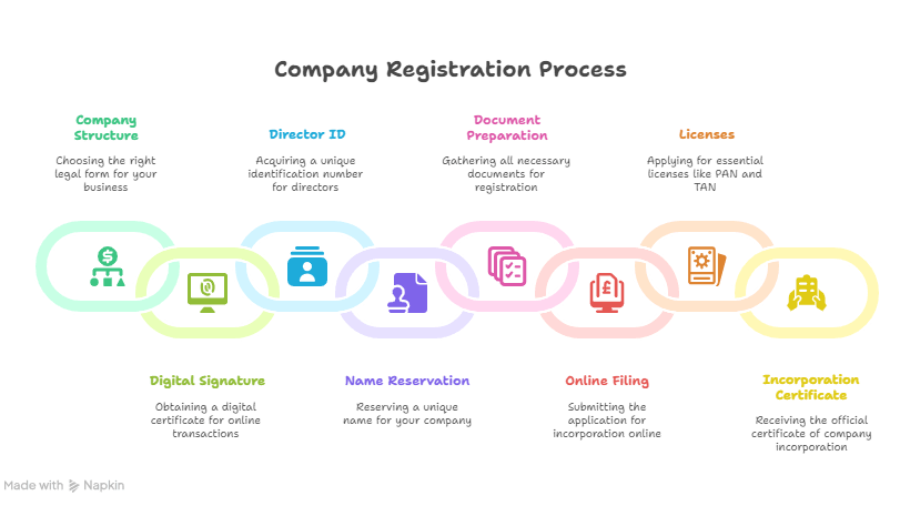

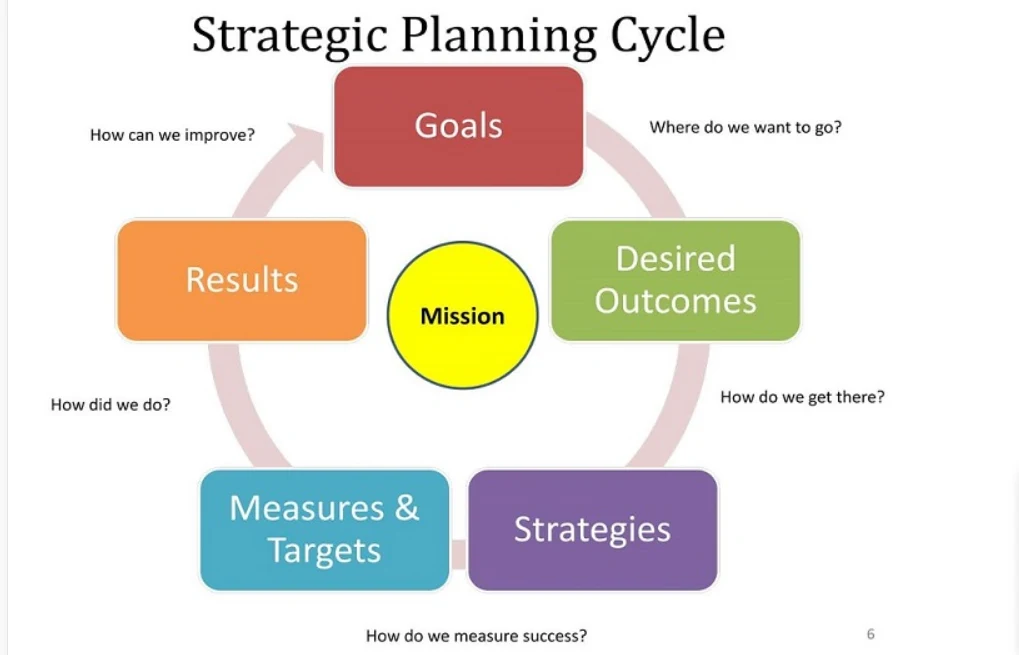

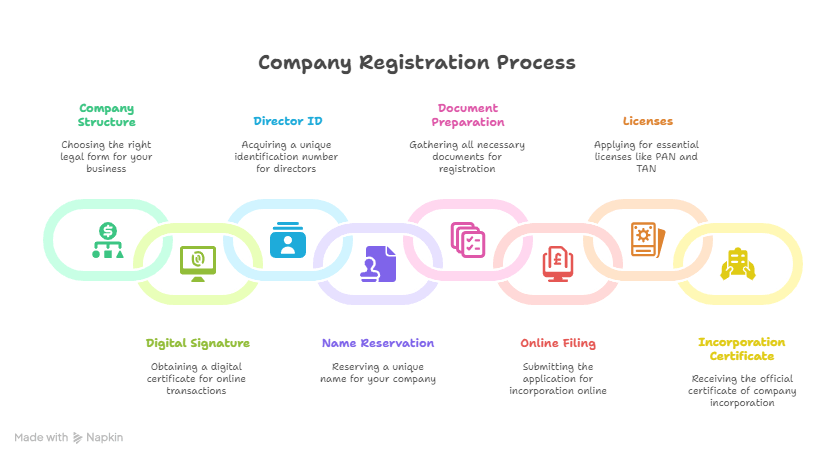

How to Register a Company in India

In this guide, we’ll walk you through the step-by-step process of registering a company in India in 2025:

- Decide your company structure

- Obtain a Digital Signature Certificate (DSC)

- Get a Director Identification Number (DIN)

- Reserve your company name

- Prepare the required documents

- File for company incorporation online

- Apply for PAN, TAN, and other licenses

- Receive your Certificate of Incorporation

By the end, you’ll have a clear roadmap to get your company legally recognized and ready for business in India.

Read more – How to start a business in 2025

Step 1 – How to Decide Your Company Structure

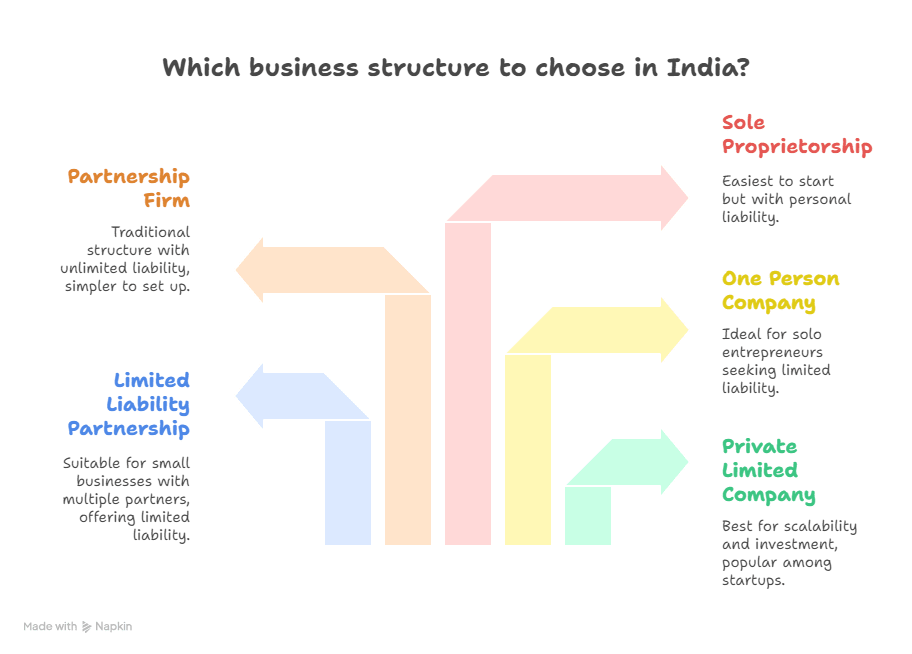

Before you begin filing forms or preparing documents, the very first decision is choosing the right company structure. In India, there are several types of business entities you can register, each with its own pros, cons, and compliance requirements.

Types of Business Structures in India

- Private Limited Company (Pvt Ltd) – Most popular among startups and small businesses looking for scalability and investment.

- Limited Liability Partnership (LLP) – Suitable for small businesses or professional services with two or more partners.

- One Person Company (OPC) – Ideal for solo entrepreneurs who want limited liability while running the business independently.

- Partnership Firm – Traditional structure for two or more partners, simpler but with unlimited liability.

- Sole Proprietorship – Easiest to start, but not a separate legal entity (owner is personally liable).

Benefits of Different Business Structure

| Business Structure | Pros | Cons | Best For |

| Private Limited Company | – Limited liability protection – Easy to raise funds – Separate legal entity | – More compliance – Annual filing costs | Startups, growing businesses, funding needs |

| LLP (Limited Liability) | – Limited liability – Less compliance than Pvt Ltd – Flexibility in partnership | – Difficult to raise VC funding – Cannot issue shares | Professional firms, consultants, SMEs |

| One Person Company (OPC) | – Limited liability – Suitable for solo founders – Easier compliance than Pvt Ltd | – Restricted to one shareholder – Limited funding opportunities | Solo entrepreneurs |

| Partnership Firm | – Easy to start – Less compliance – Simple structure | – Unlimited liability – Not recognized by investors or lenders | Family businesses, small joint ventures |

| Sole Proprietorship | – Easiest to set up – Complete control – Low cost | – Unlimited liability – Not a separate legal entity – Difficult to scale | Freelancers, very small businesses |

Guidance on Choosing the Right Structure

- Looking for investors or planning to scale? → Go for a Private Limited Company.

- Want flexibility with partners but less compliance than Pvt Ltd? → Choose an LLP.

- Solo entrepreneur testing the waters? → Consider an OPC.

- Small, family-run or traditional business? → A Partnership Firm may suffice.

- Freelancer or micro-business owner? → Start with a Sole Proprietorship.

Key takeaway: Choosing The right company structure depends on your business goals, funding requirements, and risk appetite. If your goal is to start a scalable business that attracts investment, a Private Limited Company is usually the best choice in 2025.

Step 2 – How to Get a Digital Signature Certificate (DSC)

Before you can file any documents online with the Ministry of Corporate Affairs (MCA), every director of the company needs a Digital Signature Certificate (DSC). Think of it as your electronic signature that ensures all forms and applications you submit online are legally valid and secure.

Why DSC is Mandatory for Directors

- The MCA portal only accepts documents signed digitally.

- It ensures authenticity, security, and non-repudiation of electronic filings.

- Prevents fraud since only authorized signatories can submit incorporation forms.

Without a DSC, your application will not move forward — making this one of the first critical steps.

Where and How to Apply for DSC

- DSCs are issued by government-approved Certifying Authorities (CAs) such as eMudhra, NSDL.

- The process is fully online:

- Visit a Certifying Authority’s website.

- Fill out the application form for DSC.

- Upload identity proof (PAN, Aadhaar, Passport) and address proof.

- Complete an eKYC verification (video or OTP-based).

- Pay the applicable fees.

- Once approved, you’ll receive the DSC as a USB token or downloadable file that can be used immediately.

Fees & Validity Details

- Cost: Usually ranges between ₹500 – ₹2,000 depending on the provider and class of DSC.

- Validity: 1 to 3 years, after which it must be renewed.

- Classes: For company registration, a Class 3 DSC is mandatory as it provides the highest level of security.

Pro Tip: Apply Early to Avoid Delays

Getting a DSC can take anywhere from 1–3 working days, depending on document verification. Many entrepreneurs lose precious time because they start this process late. Apply for your DSC as soon as you finalize your directors — this ensures smooth progress in the registration timeline.

Step 3 – How to Get a Director Identification Number (DIN)

Once you have your DSC in place, the next step is to obtain a Director Identification Number (DIN). This is a unique 8-digit number issued by the MCA to every company director in India.

Role of DIN in Accountability

- Acts as a permanent identification number for directors.

- Tracks the involvement of an individual across multiple companies.

- Ensures transparency and accountability, preventing fraud or misuse of directorships.

Documents Required for DIN Application

To apply for a DIN, directors need to provide:

- PAN Card (mandatory for Indian nationals).

- Identity Proof (Aadhaar, Passport, or Voter ID).

- Address Proof (utility bill, bank statement, or Aadhaar showing current address).

- Passport-sized Photograph.

Note: For foreign directors, documents must be notarized and apostilled as per MCA rules.

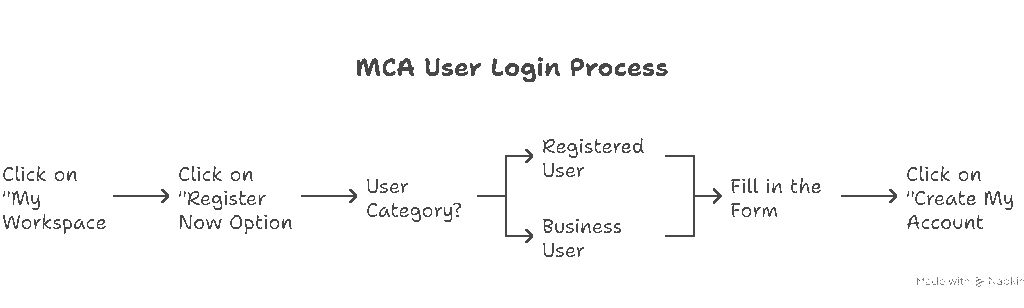

Applying via SPICe+ Form

- DIN can be obtained while filing the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) form on the MCA portal.

- For new companies: Up to 3 directors can apply for DIN directly in the SPICe+ form.

- For existing directors without DIN: They must apply separately using Form DIR-3.

This streamlined process makes it easy for first-time entrepreneurs to secure both DIN and incorporation in a single step.

How Long It Takes to get DIN

On average, if all documents are in order, DIN approval takes 1–2 business days. For example, a small IT startup in Bangalore recently registered as a Private Limited Company in early 2025. The two founders applied for DSC and DIN together via the SPICe+ form — their DINs were issued within 48 hours, allowing them to move quickly to the company name reservation step.

Key takeaway: Make sure your identity and address proofs are recent (not older than two months), or your application may get rejected, causing delays.

Step 4 – How to Reserve Your Company Name

Your company name is more than just a label — it represents your brand identity, credibility, and recognition in the market. The Ministry of Corporate Affairs (MCA) requires every company name to meet specific guidelines before approval.

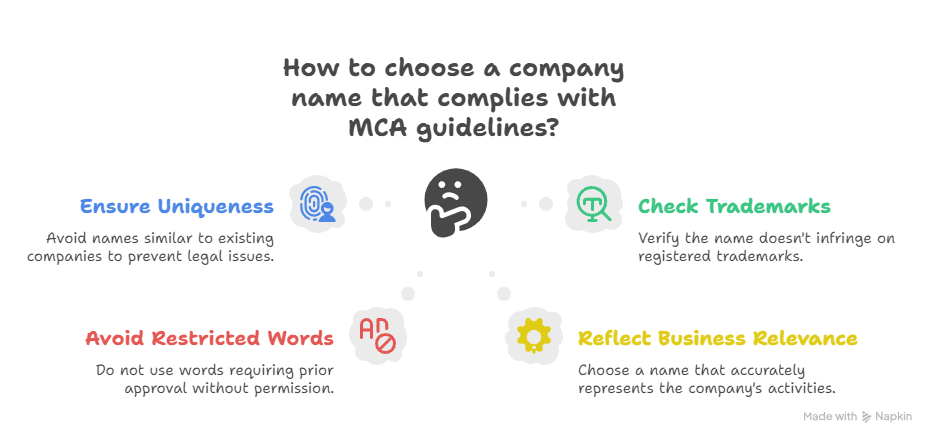

MCA Name Guidelines (Uniqueness & Trademarks)

When selecting a name, make sure it complies with these MCA rules:

- Uniqueness: The name must not be identical or too similar to an existing registered company or LLP.

- Trademark Check: Ensure the name doesn’t infringe on an existing registered trademark. A quick search on the IP India Trademark Database can save time.

- No Restricted Words: Words like National, Bank, Stock Exchange, Government, Mutual Fund, Insurance require prior approval from relevant authorities.

Business Relevance: The name should reflect the nature of your company’s activities. For example, Tech Solutions Pvt Ltd for an IT company.

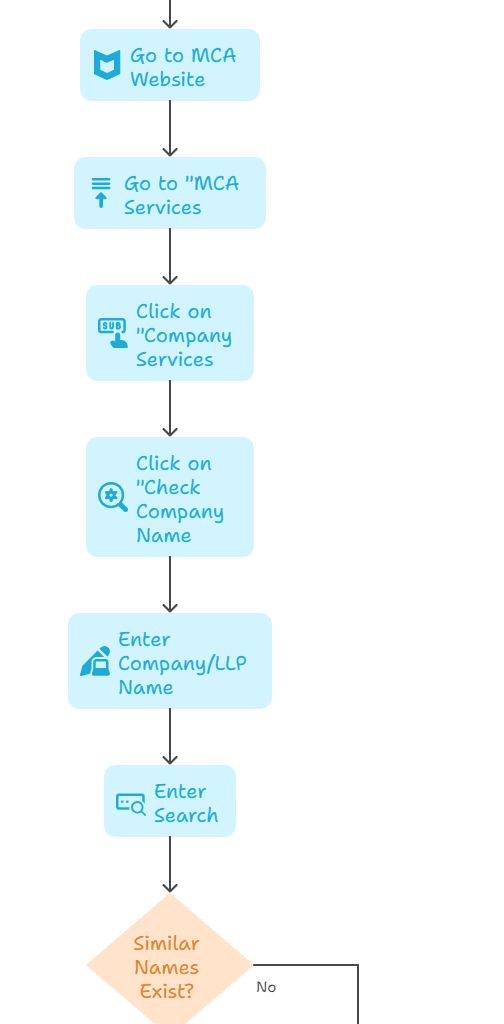

RUN vs SPICe+ Part A Service

The MCA provides two ways to reserve your company name:

- RUN (Reserve Unique Name) service

- Best for reserving the company name before filing incorporation documents.

- You can propose 2 names in one application.

- If rejected, you must reapply with fresh payment.

- Best for reserving the company name before filing incorporation documents.

- SPICe+ Part A form

- Lets you apply for name reservation alongside incorporation.

- Cost-effective if you’re certain about your name choice.

- Saves time as both steps (name approval + incorporation) are combined.

- Lets you apply for name reservation alongside incorporation.

Practical Tips for Getting Quick Business Name Approval

- Suggest at least 2 names (one primary, one backup) to improve chances.

- Avoid generic terms like consultancy, services, solutions unless combined with a unique identifier.

- Run a domain name search — securing the .com or .in domain for your business helps with branding.

- Always check both MCA database and trademark database before applying.

Pro Tip: A name approval usually takes 2–3 working days. Choosing creative but professional names significantly reduces rejection chances.

Step 5 – What are Required Documents to Register a Company

Once your company name is reserved, the next step is document preparation. Having the correct paperwork ready ensures a smooth and speedy incorporation process.

List of Documents Required For Company Registration for Indian

- PAN Card (mandatory for Indian nationals).

- Aadhaar Card/Passport/Voter ID/Driving License (identity proof).

- Address Proof (utility bill or bank statement, not older than 2 months).

- Passport-sized Photograph (recent).

- Registered Office Proof:

- Utility bill (electricity, water, gas) not older than 2 months.

- Rent Agreement + NOC from landlord if office is rented.

- Ownership document if self-owned.

- Utility bill (electricity, water, gas) not older than 2 months.

- Consent to Act as Director (DIR-2).

- Declaration by first subscribers and directors (INC-9).

- Memorandum of Association (MOA) – defines the objectives of the company.

- Articles of Association (AOA) – outlines internal rules and management structure.

List of Documents Required (Foreign Directors/Shareholders)

- Passport (mandatory).

- Proof of Address (bank statement, driving license, or residence card).

- Passport-sized Photograph.

- All documents must be notarized and apostilled in the home country (or consularized at the Indian Embassy if apostille is not available).

Quick Reference Table – Required Documents

| Document | Requirement / Purpose |

| PAN Card (Indians) | Mandatory identity proof for directors/shareholders |

| Aadhaar/Passport/Voter ID | Secondary identity proof |

| Address Proof (Utility Bill) | Residential verification (not older than 2 months) |

| Passport (Foreign Nationals) | Mandatory ID proof for foreign directors |

| Registered Office Proof | Utility bill + Rent Agreement/NOC or Ownership docs |

| MOA & AOA | Company objectives and internal rules |

| DIR-2 | Director’s consent to act |

| INC-9 | Declaration by subscribers and directors |

| Passport-sized Photo | Identification |

Note on Notarization/Apostille for Foreign Shareholders

If your company has foreign directors or shareholders, their documents must undergo notarization and apostille in their home country, as per the Hague Convention. If the country is not part of the convention, the documents should be consularized at the Indian Embassy.This step is often where delays occur, so international entrepreneurs should begin document authentication well in advance.

Step 6 – How to File Company Incorporation Online

Once your documents are ready, it’s time to officially apply for company incorporation through the MCA portal. This step is where all your efforts come together to give your business a legal identity.

Filling the SPICe+ Part B Form

The MCA has simplified the registration process using the SPICe+ (Simplified Proforma for Incorporating a Company Electronically Plus) form. Part B of this form is specifically for incorporation.

Here’s what you’ll need to provide:

- Company details: Proposed name, type of company, class (Private/Public), and structure (Limited by Shares/Guarantee).

- Capital structure: Authorized and paid-up capital details.

- Registered office address: Proof of ownership/rent agreement and utility bills.

- Subscribers’ and directors’ details: Names, DINs, PAN, and identity/address proofs.

- MOA & AOA: Attach signed versions defining objectives and internal management rules.

Signing with DSC

- Every director and subscriber must digitally sign the SPICe+ Part B form using their Class 3 DSC.

- Without valid DSCs, the form cannot be submitted.

- The signed form is then uploaded directly on the MCA portal.

Common Mistakes Applicants Make

Many first-time entrepreneurs face rejection due to small errors. Avoid these mistakes:

- Submitting outdated address proofs (must not be older than 2 months).

- Forgetting to attach NOC from landlord if the office is rented.

- Entering mismatched details (e.g., name spelling differences across PAN, Aadhaar, DSC).

- Uploading unsigned or improperly formatted MOA and AOA.

- Not cross-verifying email ID and mobile number (important for OTP verification).

Pro Tip: Double-check every entry before final submission — even a minor mismatch can result in delays of 7–10 working days.

Step 7 – Apply for PAN, TAN & Other Licenses

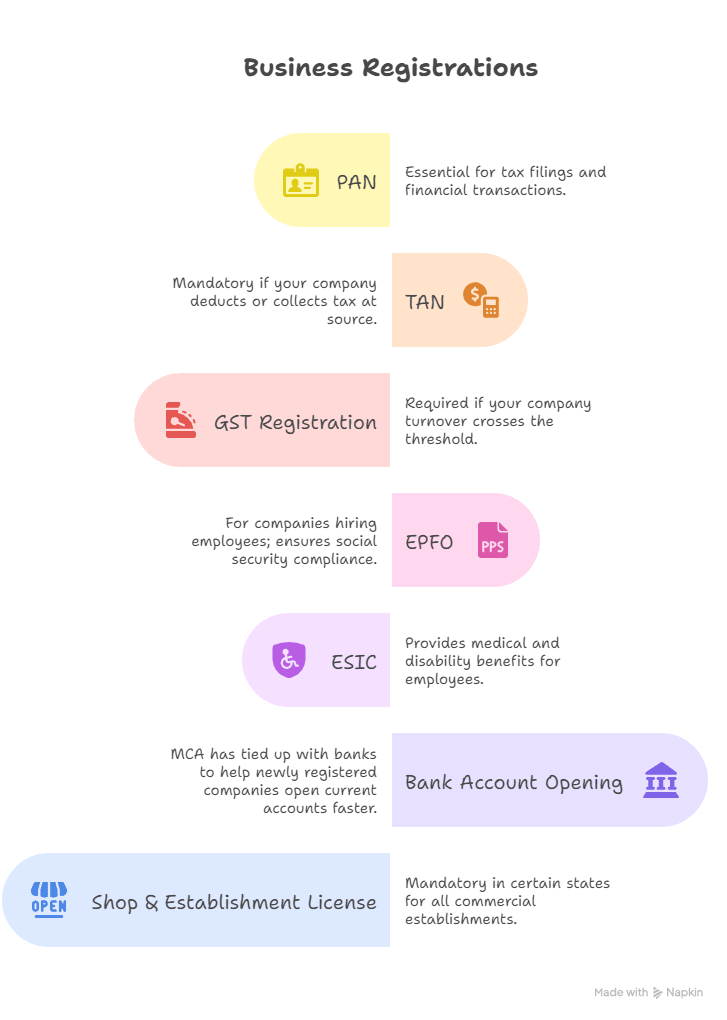

The MCA has further streamlined the process by integrating multiple registrations into one form: AGILE-PRO-S. This means you don’t have to apply for separate licenses after incorporation — you can get them simultaneously.

Role of AGILE-PRO-S Form

AGILE-PRO-S allows you to apply for:

- PAN (Permanent Account Number) – Essential for tax filings and financial transactions.

- TAN (Tax Deduction and Collection Account Number) – Mandatory if your company deducts or collects tax at source.

- GST Registration – Required if your company turnover crosses the threshold (₹40 lakhs for goods, ₹20 lakhs for services; lower for some states).

- EPFO (Employees’ Provident Fund Organization) – For companies hiring employees; ensures social security compliance.

- ESIC (Employees’ State Insurance Corporation) – Provides medical and disability benefits for employees.

- Bank Account Opening – MCA has tied up with banks to help newly registered companies open current accounts faster.

State-Level Shop & Establishment License – Mandatory in certain states for all commercial establishments.

Practical Tip: Apply Simultaneously to Save Time

The beauty of the AGILE-PRO-S form is that it consolidates multiple applications into one. Instead of waiting weeks after incorporation to apply for GST, EPFO, or ESIC separately, you can complete them in one go. This not only saves time but also ensures your business is legally ready to start your business fast.

Step 8 – Receive Certificate of Incorporation (COI)

Once all documents and forms are successfully filed and verified by the Ministry of Corporate Affairs (MCA), you will receive the Certificate of Incorporation (COI) — the final and most important document in the company registration process.

What the COI Contains

The COI serves as legal proof of your company’s existence. It usually includes:

- Corporate Identification Number (CIN): A unique ID for your company.

- Permanent Account Number (PAN): Issued by the Income Tax Department.

- Tax Deduction and Collection Account Number (TAN): Needed for deducting and depositing TDS.

With this certificate in hand, your business becomes a separate legal entity, capable of entering contracts, opening a bank account, and raising investments.

Typical Approval Timeline

- On average, it takes 7–10 working days from submission to approval.

- However, the timeline may vary based on workload at MCA and accuracy of submitted documents.

Next Steps After Incorporation

Once you receive the COI, here’s what you should immediately do:

- Open a company bank account with your Certificate of Incorporation, PAN, and other documents.

- Register under mandatory compliances such as GST (if applicable), Shops & Establishment Act (state-wise), and professional tax.

- Maintain statutory registers and conduct your first board meeting within 30 days.

- Ensure timely annual filings (ROC filings, IT returns, GST returns) to avoid penalties.

👉 Pro Tip: Hire a company secretary or compliance service provider early on to ensure you never miss a filing deadline.

Quick Reference Table – Required Documents for Registration

| Document | Requirement / Purpose |

| PAN Card | Mandatory for all directors and shareholders (Indian nationals). |

| Aadhaar / Passport / Voter ID | Identity & address proof of directors. |

| Passport-sized Photo | Needed for all directors to create digital records. |

| Office Address Proof | Utility bill (not older than 2 months), Rent Agreement, or NOC from owner. |

| MOA & AOA | Memorandum & Articles of Association – define company rules & objectives. |

| DIR-2 | Consent form from directors to act as company directors. |

| INC-9 | Declaration by directors and subscribers stating compliance with laws. |

👉 Note for Foreign Shareholders/Directors: All documents must be notarized and apostilled in the home country before submission in India.

Additional Tips & Common Mistakes to Avoid

Even though company registration in India is now mostly online and streamlined, many entrepreneurs still face avoidable delays due to small errors. Here’s what to keep in mind:

✅ Tips for a Smooth Registration Process

- Double-check that your proposed company name is unique and not too similar to existing trademarks.

- Keep all director details consistent across documents (same spelling of names, addresses, etc.).

- Use the same email ID and mobile number across MCA and PAN applications for faster OTP verification.

- Apply for multiple registrations simultaneously (GST, EPFO, ESIC, bank account) through AGILE-PRO-S to save time.

- Consider hiring a professional (CA/CS) if you’re new to legal compliances — it can save weeks of hassle.

❌ Common Mistakes Applicants Make

- Not checking name availability properly → Leads to rejection at the first step.

- Incomplete document submission → Missing NOC or outdated utility bills often cause delays.

- Delays in notarization/apostille for foreign directors → Plan this well in advance if your company has international shareholders.

- Skipping GST/EPFO registration when required → May result in penalties later.

- Ignoring post-registration compliances like annual filings, board meetings, and ROC submissions → This can even lead to company strike-off by MCA.

👉 Pro Tip: Always maintain a compliance calendar to track annual returns, tax filings, and board resolutions

Useful Resources & Links– Here are some trusted resources to guide you further:

- Ministry of Corporate Affairs (MCA) Portal – Official government site for all registrations, filings, and updates.

- IndiaFilings – Company Registration Guide – Step-by-step help for entrepreneurs.

- ClearTax – Company Incorporation Process – Simplified breakdown with FAQs.

- Startup India – Schemes, benefits, and support programs for startups.

Frequently Asked Questions (FAQs)

1. How long does it take to register a company in India in 2025?

On average, the company registration process in India takes 7–10 working days, provided all documents are in order and there are no discrepancies. Delays may occur if the company name gets rejected, documents are incomplete, or there are issues with director verification.

2. What is the cost of company registration in India?

The cost of registering a private limited company in India typically ranges between ₹7,000 – ₹15,000 depending on the state of registration, number of directors, and professional fees (if you hire a CA/CS). Additional costs may apply for GST registration, shop & establishment license, or other industry-specific permits

3. Can a foreigner register a company in India?

Yes, a foreigner can register a company in India, usually as a Private Limited Company. At least one director must be an Indian resident, and foreign directors need to provide notarized/apostilled documents such as passport and address proof. Depending on the business activity, RBI and FEMA regulations may also apply.

4. Is GST mandatory for all companies?

No, GST is not mandatory for all companies. Businesses must register for GST if their annual turnover exceeds ₹40 lakhs (₹20 lakhs for service providers). However, certain businesses — like e-commerce sellers or inter-state service providers — are required to register for GST regardless of turnover.

5. What is the difference between LLP and Pvt Ltd company?

–LLP (Limited Liability Partnership): Best for small businesses and professional services. Compliance requirements and costs are lower. Ownership is managed by partners.

–Private Limited Company: Preferred by startups and growing businesses. Allows equity funding, ESOPs, and easy transfer of shares. Compliance is slightly higher but offers better credibility with investors and banks.

👉 In short: Choose LLP if you want fewer compliances, and go for a Pvt Ltd if you aim for growth and fundraising.

6. What documents are required for company registration?

The basic set of documents includes:

PAN and Aadhaar/Voter ID of all directors

Passport-size photographs

Address proof of directors (utility bill, bank statement, or Aadhaar)

Proof of registered office (rent agreement/ownership documents + utility bill)

Memorandum of Association (MOA) & Articles of Association (AOA)

Consent forms from directors

7. What is a Director Identification Number (DIN) and how do I get it?

DIN is a unique ID number assigned to every director of a registered company in India. You can apply for it while filing the SPICe+ incorporation form on the MCA portal

8. Can I register my company in India completely online?

Yes. The MCA portal allows 100% online registration using digital signatures and scanned documents. Physical visits are not required.

9. What happens after my company is registered?

Once you receive the Certificate of Incorporation, you’ll also get your CIN (Company Identification Number), PAN, and TAN. You can then:

Open a company bank account

Apply for GST, EPFO, or other licenses if applicable

Begin filing mandatory annual returns and compliances